All Categories

Featured

Table of Contents

That usually makes them a more budget friendly choice for life insurance protection. Some term policies might not keep the premium and survivor benefit the very same gradually. Level benefit term life insurance. You don't wish to incorrectly believe you're acquiring degree term protection and after that have your survivor benefit change later on. Many individuals get life insurance policy protection to aid financially shield their loved ones in case of their unexpected death.

Or you may have the choice to convert your existing term coverage right into a long-term policy that lasts the remainder of your life. Different life insurance policy plans have potential advantages and disadvantages, so it's important to comprehend each before you decide to buy a policy.

As long as you pay the premium, your beneficiaries will certainly obtain the fatality benefit if you pass away while covered. That said, it is necessary to keep in mind that many plans are contestable for two years which implies protection could be rescinded on death, should a misstatement be discovered in the app. Plans that are not contestable commonly have actually a graded death advantage.

What is Level Premium Term Life Insurance and Why Is It Important?

Premiums are generally lower than entire life plans. You're not locked into an agreement for the rest of your life.

And you can not squander your plan throughout its term, so you won't obtain any financial gain from your past coverage. As with various other kinds of life insurance policy, the expense of a level term plan depends upon your age, protection requirements, work, way of living and wellness. Usually, you'll find more affordable insurance coverage if you're more youthful, healthier and less high-risk to insure.

Because degree term costs remain the same for the duration of insurance coverage, you'll recognize specifically how much you'll pay each time. Level term protection additionally has some adaptability, enabling you to tailor your plan with extra attributes.

What is Term Life Insurance With Accidental Death Benefit? Explained in Detail

You may have to satisfy certain conditions and certifications for your insurance company to establish this cyclist. There also could be an age or time restriction on the coverage.

The death advantage is typically smaller, and insurance coverage normally lasts until your youngster transforms 18 or 25. This cyclist may be a much more affordable way to help guarantee your youngsters are covered as bikers can typically cover multiple dependents simultaneously. When your youngster ages out of this protection, it may be feasible to transform the cyclist into a brand-new policy.

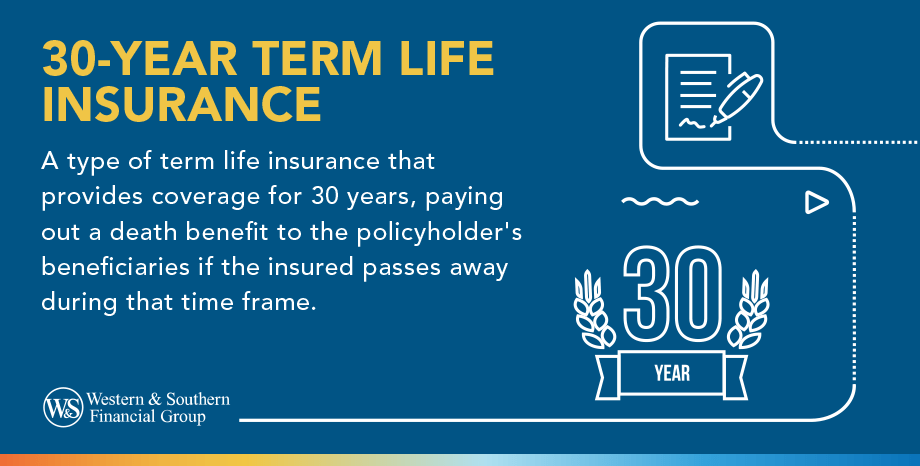

When comparing term versus irreversible life insurance policy, it is necessary to bear in mind there are a few various types. The most typical kind of long-term life insurance policy is whole life insurance policy, but it has some crucial distinctions compared to degree term coverage. term life insurance for seniors. Right here's a basic overview of what to consider when contrasting term vs.

Whole life insurance policy lasts permanently, while term protection lasts for a details duration. The costs for term life insurance policy are normally reduced than whole life protection. With both, the premiums remain the exact same for the period of the plan. Entire life insurance policy has a cash money worth component, where a portion of the premium might grow tax-deferred for future requirements.

One of the highlights of level term coverage is that your premiums and your survivor benefit do not change. With reducing term life insurance policy, your premiums stay the same; however, the fatality benefit amount gets smaller sized with time. As an example, you might have coverage that starts with a fatality benefit of $10,000, which can cover a home mortgage, and after that every year, the death advantage will certainly lower by a set amount or percent.

Due to this, it's usually a more inexpensive kind of degree term protection., however it may not be sufficient life insurance coverage for your requirements.

What is Term Life Insurance Coverage Like?

After picking a plan, complete the application. For the underwriting process, you might need to offer basic individual, wellness, way of life and work info. Your insurance provider will certainly figure out if you are insurable and the risk you may present to them, which is shown in your premium expenses. If you're approved, sign the paperwork and pay your initial costs.

Ultimately, take into consideration organizing time annually to review your plan. You might wish to upgrade your beneficiary details if you have actually had any considerable life adjustments, such as a marital relationship, birth or separation. Life insurance coverage can sometimes feel difficult. Yet you do not have to go it alone. As you explore your alternatives, consider reviewing your needs, desires and interests in an economic professional.

No, level term life insurance does not have money value. Some life insurance policies have a financial investment feature that enables you to build money value in time. A section of your costs settlements is reserved and can make interest over time, which expands tax-deferred throughout the life of your protection.

Nonetheless, these plans are usually considerably a lot more expensive than term insurance coverage. If you get to completion of your plan and are still active, the coverage ends. Nonetheless, you have some choices if you still desire some life insurance protection. You can: If you're 65 and your insurance coverage has actually run out, for instance, you may want to get a new 10-year level term life insurance coverage plan.

How Term Life Insurance For Couples Can Secure Your Future

You might have the ability to convert your term insurance coverage into an entire life policy that will last for the remainder of your life. Many kinds of degree term plans are exchangeable. That suggests, at the end of your insurance coverage, you can transform some or every one of your policy to whole life coverage.

A degree premium term life insurance plan allows you stick to your budget plan while you assist shield your household. Unlike some stepped rate strategies that boosts yearly with your age, this sort of term strategy supplies rates that remain the exact same for the duration you pick, also as you age or your wellness adjustments.

Find out more about the Life insurance policy options readily available to you as an AICPA participant (term life insurance for seniors). ___ Aon Insurance Solutions is the trademark name for the brokerage firm and program administration operations of Fondness Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Solutions Inc.; in CA, Aon Fondness Insurance Coverage Providers, Inc .

Latest Posts

Funeral Insurance For Over 50's

Burial Insurance Aarp

Instant Whole Life Insurance Quotes